Chris Baker, Virpi Barrett

Image by Valentin Schönpos from Pixabay

While we can’t predict what will cause the next energy crisis, we can be quite confident that one will arise, probably rather sooner than later. Most people will not expect it to happen until it does and will call it “unprecedented” – the new favourite word as record weather events and natural disasters occur weekly in global news.

In addition to the traditional geopolitical threats, we now need to prepare for cyber-attacks, pandemics, resource scarcities and collapses of various economic sectors or trade relationships. With the ever-increasing interconnectedness, it is harder than ever to forecast the impacts of these threats across sectors, but energy plays a central role for sure.

A key success factor in managing energy crises in a decarbonised grid is seasonal energy storage or ultra-deep storage, as we like to call it. While the discussion has traditionally circled around pros and cons of different energy storage technologies like pumped hydro and flow batteries, the most cost-efficient solutions may actually lie outside of the electricity sector.

Sunshine Hydro is proposing an alternative form of storage with an order of magnitude cheaper capital cost. This ultra-deep storage can also double as a national fuel security strategy: e-methanol.

An ultra-deep e-methanol storage

Methanol, also called wood alcohol is conventionally derived from fossil fuels, but it can alternatively be made of hydrogen and biomass. Similar to fossil fuels used today, methanol is a flammable liquid stored at normal temperature and pressure. Methanol has an existing market as a fuel, and it is the precursor to many common chemicals and other fuels. It can also be reformed to deliver hydrogen at a point of use or converted back to electricity in a fuel cell.

Converting electricity to hydrogen and then back to electricity is criticised due to the high round-trip losses – and the same would apply to e-methanol. However, in this case, the round-trip efficiency is not relevant altogether because the stored e-methanol is not turned back into electricity but used as a commodity (apart from some extreme situations, but then it would be worth the losses).

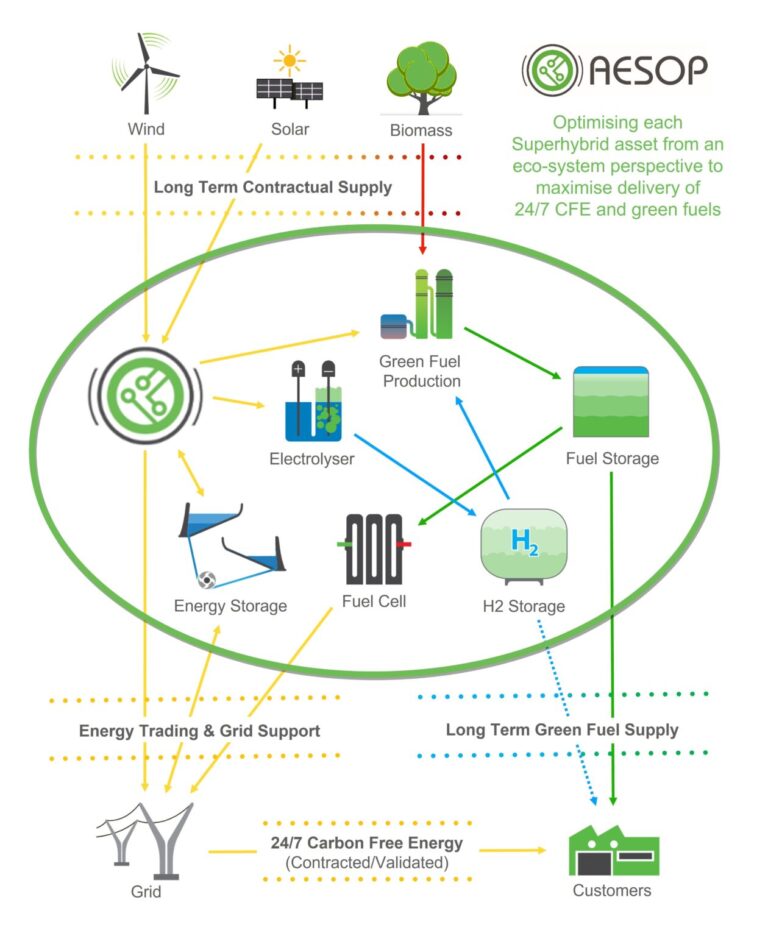

Instead of using the ultra-deep e-methanol storage like a traditional “charge and discharge” battery, it can be optimised as part of a larger asset ecosystem. Sunshine Hydro has developed such concept called Superhybrid™.

A Superhybrid involves a cleverly optimised pumped hydro or other long-duration energy storage and flexible load like e-methanol production. It transforms intermittent renewable energy into 24/7 carbon-free electricity and a steady stream of green fuels. While the produced e-methanol is sold through continuous supply contracts, the delivery may come straight from the production process or from the e-methanol storage. Therefore, the storage enables the Superhybrid to turn the production off and sell the reserved electricity back to the market as needed, as effectively as a discharging battery would.

There is no technical upper limit for the depth of the e-methanol storage because it is modular and can be easily expanded by adding more tanks. However, a Superhybrid can also respond to short-term daily peaks and provide grid support in a normal market situation, earning arbitrage revenues and keeping consumer prices reasonable. It is the combination of pumped hydro and flexible load, that enables multiple revenue streams and a bankable business case for investors.

Fuel security

While this article focuses on e-methanol as a national electricity security reserve, we must point out that it can alternatively – and to an extent simultaneously – act as a fuel reserve that keeps food trucks and other heavy transport on the road.

There are trucks available today that run on methanol and are offered by various truck vendors such as Geely (China), Asok-Leyland (India) and Dor (Israel). These vehicles use internal combustion engines, providing an easy first step in decarbonising transport to run on methanol. Alternatively, methanol can be used in a fuel cell to power an electric vehicle or other devices – for example, it is currently used to power remote telecommunications sites.

Methanol is rapidly gaining market share in the marine sector with 10% of the ships contracted this year able to run on methanol [DNV, Alternative Fuels Insight Platform]. Smaller vessels such as tugs are already running on methanol as a fuel both in reciprocating engines and fuel cells.

As the transport and delivery logistics chains develop it becomes increasingly easy to use methanol in other industries such as agriculture, construction and mining – which are also important sectors for national security and resilience.

For a decade Australia has fallen short of its obligation to stock at least 90 days of oil net imports as a member of the International Energy Agency (IEA). Transition to e-methanol would simultaneously reduce the need to import oil and enable stockpiling alternatives that would be subsidised through electricity market optimisation.

It’s time for national fuel security to turn green as well.

Capital costs

It is very challenging or virtually impossible to build a pumped hydro with large-scale 3-month storage, and even more so using batteries. However, these are the closest comparisons to make when assessing the capital cost of deep e-methanol storage.

The capital cost of Borumba Pumped Hydro Project in QLD is estimated at $14.2 billion. It’s a 2,000 MW pumped hydro station with 24-hour reservoir and is planned to be operational by 2030. The capital cost per energy capacity is nearly $300 per kWh.

The price of a 12-hour vanadium flow battery system with 100 MW power capacity costs currently over $800 million. This is about $700 per kWh. Both alternatives are economically challenging as a stand-alone business, to say the least.

When energy is stored by using a surrogate as “raw energy not needed”, the capital cost reduces to the incremental cost of increasing the production capacity, storing the product, and managing the stockpile.

Let’s assume a methanol plant that draws 100 MW from the grid to supply 300 tonnes of e-methanol per day through a long-term contract. Let’s then add a 3-month ultra-deep storage capability to it and allow 2 years to build the storage up. The capex spent on the extra electrolysers and storage tanks is about $70 million – an order of magnitude cheaper than the alternatives (if scaled to the same power capacity, i.e. 100 MW).

However, the jaw-dropping comparison comes from capex per energy capacity. In this example, it is $0.32 per kWh for energy storage that can last 3 months. PHES capex per kWh is over 900 times more for one day of storage and the battery capex is over 2,000 times more for half a day. Ultra-long duration storage may just have started to make economic sense – even though there are still no market structures to truly incentivise it.

It is important to note, that the delivery of this extra energy to the electricity market at the right times would require optimisation as part of an asset ecosystem. Digital twin models of Superhybrid have shown that assets like pumped hydro can be optimised profitably as part of the right mix of generation and loads. Adding the extra storage capacity of e-methanol would extend this capability to balance seasonal variations of the grid.

The opportunities ahead

This is an example of how thinking outside of the box can reveal opportunities to increase resilience and accelerate decarbonising our electricity grid and even provide additional benefits. The electricity sector needs to think creatively to identify energy-intensive products that can be easily stored and stockpiled and where the production process enables some level of ramping.

Typically, these businesses would be focused on maximising production and minimising shelf life, so it’s up to the energy sector, together with the governments, to incentivise the change. Perhaps, in addition to synthetic fuels like e-methanol or Sustainable Aviation Fuel (SAF), further examples could be found in cryogenic distillation or elsewhere in chemical processes.

It’s time to truly know your customers.