Virpi Barrett

Image by Gerd Altmann via Pixabay

Following the announcement of $2/kg Hydrogen Production Tax Incentive (HPTI), the Treasury ran a public consultation about the scheme. As often is the case, the devil is in the detail and the careful planning of this subsidy is paramount to avoid unintended adverse consequences to the Australian energy transition and leakage of subsidies outside of Australian borders.

Below is an extract from our submission to explain.

We find that providing subsidies in the form of a production tax credit is the most effective way to support a new industry to grow. We are pleased that HPTI is a reliable subsidy that businesses can plan on and that it provides a level playing field for competing projects and companies. The basic design of the incentive also creates the urgency that is required from the energy transition as a response to climate change.

The most important problem of the high-level design presented in the consultation paper is the lack of requiring hourly time-matching, additionality and locational matching. We acknowledge that these requirements are challenging to overcome and some may view them as barriers, however they are not prohibitive, they bring a variety of benefits, and they are used in other countries for a very good reason.

When the US joined the EU with almost identical requirements for green hydrogen (with only minor discrepancies on the timelines), the international standard was clearly set. Ignoring these requirements will risk resulting in a number of adverse outcomes for the Australian context, which we will detail below.

Importance of hourly and locational matching and additionality

The EU and the US have designed their hydrogen schemes based on these basic requirements to avoid the adverse impacts to the electricity market from the introduction of large-scale hydrogen production. If the renewable energy is cherry-picked from the existing electricity grid for creating “green” hydrogen while the emission intensity of the remainder of the grid electricity increases as a result, the overall decarbonisation of the energy sector is not progressed at all.

It is imperative that a new demand of such scale comes with additional renewable generation and that this generation can physically be transmitted to the location of the consumption – otherwise the new demand exacerbates the transitional challenges the electricity market is already grappling to manage.

International competitiveness of the Australian industry and products

If the Australian green hydrogen does not match the international standards, it means that the products, like green metals produced using that hydrogen, will not be recognised as ‘green’ outside of Australia. This creates an additional barrier for export as international buyers will know that a typical Australian producer will not comply with the standard, and they look elsewhere.

Risk of leaking the subsidy abroad

There is a risk that Australian companies exporting ‘green’ hydrogen that does not meet the international standards, must pay border carbon tax or similar penalties at the border through mechanisms like Carbon Border Adjustment Mechanism (CBAM) in EU or UK for example.

Essentially this means that the economic benefit provided by HPTI may make the Australian green products competitive enough to win the deal, only to transfer the subsidy at the border to the importing countries.

Encouraging generation at the wrong time

The challenge of having vast amounts of solar generation in a grid is well known. Early subsidies, like Renewable Energy Target (RET) have done a great job at introducing renewable energy into the Australian grid and continue to do so. However, it is good to have a critical look at this scheme and learn from it.

Currently, the over-supply of solar energy in the middle of the day is frequently pushing the prices negative. This is possible because the solar generators can use the RET subsidies to compensate for the negative price on the electricity market. This makes the market as whole rather dysfunctional. As with any commodity, there must be a compensation for the goods sold. As a result of the negative prices the price of the following hours will be even more expensive. This creates hard-to-manage price risk, which increases the cost to the retailers and eventually to the consumers.

It is clear that this outcome was not foreseen at the time of designing RET and hence the mistake is understandable. However, repeating the same mistake with hydrogen now, when the writing is clearly on the wall, would be a serious oversight.

Solar is the cheapest form of electricity generation and hence a likely choice for producing green hydrogen, which is already under serious cost pressure to match the lower-cost fossil-fuel-based production. The same pressure would also encourage maximising the utilisation rate of the electrolysers, i.e. to produce as close to 24/7 as possible. Given that sunshine is only available about a third of the time, such a hydrogen producer would need to contract about 3-times the amount of solar it uses during the sun hours. Two-thirds of the solar generation underwritten by this hydrogen producer would go into the grid without a dedicated user and the electrolyser would continue to draw from the grid through the evening and night, exacerbating the solar challenge the grid is already struggling to manage.

Undermining the work done within the Capacity Investment Scheme

The Capacity Investment Scheme (CIS) introduced by the Federal Government is addressing the challenge of managing variable renewable energy in the grid by encouraging long-duration storage projects that will time-shift the excess energy to times when it is needed. As explained above, if the HPTI only requires annual netting of the sourced renewable energy instead of hourly matching, it would further subsidise generation at the time when it is not needed.

It would be absurd to create a parallel subsidy that would worsen the problem that is already being corrected through public spending under another scheme.

The way forward

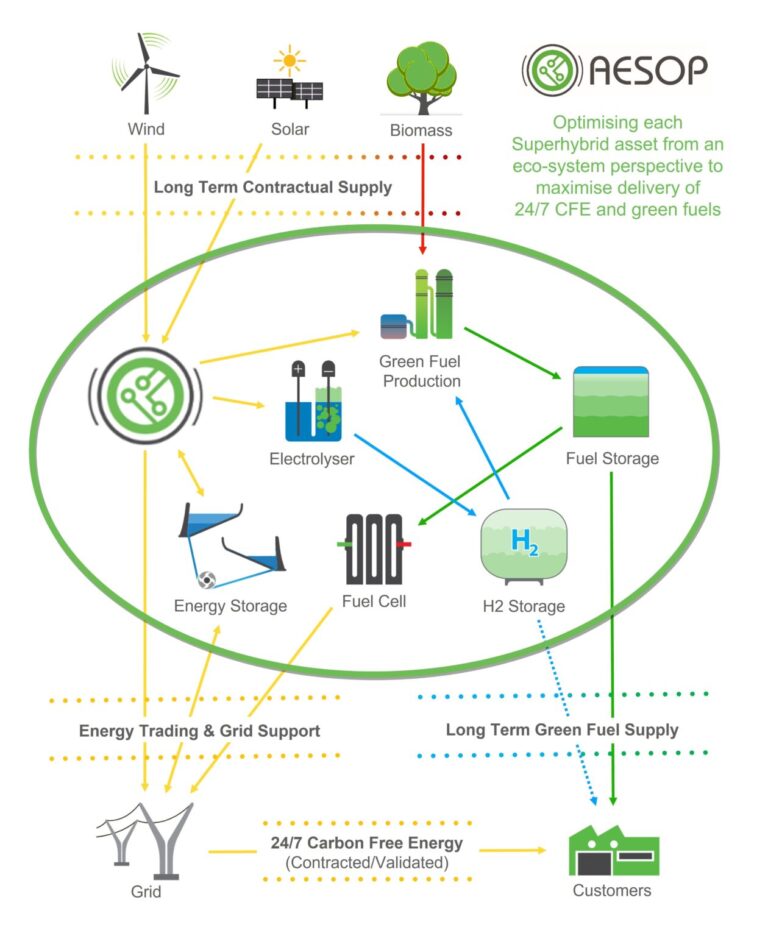

At Sunshine Hydro we have spent years developing the SuperhybridTM concept, that not only makes the business case for long-duration storage ‘bankable’, but also produces the products that are necessary for decarbonising the energy sector in the near future: 24/7 carbon-free electricity and green fuels.

Utilising the excess renewable energy is an essential part of the concept and hydrogen production has provided this flexible load for the SuperhybridTM asset ecosystem.

Our concept demonstrates that there is a way to comply with international standards for hydrogen and to decarbonise our electricity and transport sectors – while making profitable business that transforms Australia into a ‘renewable energy superpower’. We are happy to share the concept, because the decarbonisation challenge ahead is vast and the time is short, so we need all hands on deck.